Hot Springs Treehouses

Once a week, we take a deep dive into an existing short term rental that is listed for sale.

This week we’re taking a deep dive into a property that contains multiple short term rentals for sale in Hot Springs, Arkansas. As with all of our deep dives we find short term rentals with a history of success on AirBnB that are currently for sale and analyze the potential return on investment.

148 & 142 Jubilee Rd, Hot Springs National Park, AR 71913

Summary

This week we are doing something slightly different and looking at a large property that contains 6 “treehouses” and a separate 1BD/1Bath cabin for sale in Hot Springs, Arkansas, within the Hot Springs National Park. A question that keeps getting asked by the short term rental investment community is whether short term rentals are a scalable business like other real estate investing (e.g. multi-family). So this week we’re looking at a property that is run more like a small hotel and analyze whether as an investor this is a more attractive investment than say a portfolio of short term rentals dispersed throughout the US. Hot Springs National Park is one of the oldest national parks in the US and is unsurprisingly known for its hot springs. The current owners have rented the properties on AirBnB for several years and have 953 review accross the 7 listings, with close to a perfect 5 star record. According to the listing agent the property does around $46,000 in average monthly revenue.

Economics

Asking Price: $3,500,000

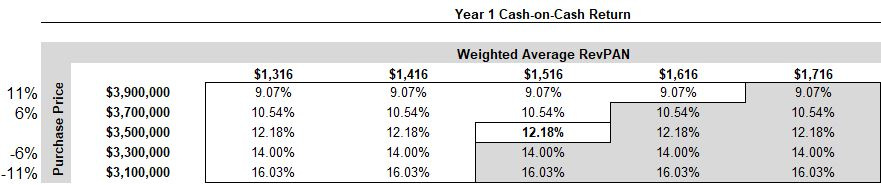

Cash-on-Cash Return: 12.18%

RevPAN: Blended $1,516

Monthly Profit: $22,381

Deep Dive

Pros

Unique property with history of success on AirBnB

Close proximity to National Park

Historically high occupancy rate over several years

Cons

Cash-on-Cash return is low even assuming signficiant operational turnaround

High entry price

Regulation within city limits has put caps on short term rentals

Areas for Improvement

Is this a boutique hotel or a short term rental investment? The property does not appear to have the amenities of a hotel but may have some operational ineffeciencies that could be improved upon. More on that below.

Stress Scenarios

For this analysis we had the benefit of historical P&L for the last two years. This gave us a pretty clear picture of what top line revenue looks like, but things were less clear when it came to expenses. The financials showed an operating business with staff, payroll, owner’s salary and other similar expenses. Even after adjusting these expenses and removing “owner lifestyle perks”, the returns were underwhelming. Which raises an interesting question about whether these types of investments scale and benefit from efficiencies or if a property like this is best suited to be evaluated as a boutique hotel. This property looks like something that would actually benefit from outsourcing management at market rates, which would be signficantly less than the current operational expenses from an on staff team.

While the cash-on-cash return could definitely benefit from some operational efficiencies, there are a few additonal items to note that have a material impact on the cash-on-cash return in this scenario. Because of the large purchase price and type of property, conventional second home mortgages are likely unavailable. So in this analysis we assumed at 75% LTV and interest rate of 6%, which with rising interest rates may be low for a DSCR mortgage.

Regulation

The City of Hot Springs recently adopted short term rental regulations that among other things, capped the number of short term rentals to 500 total in areas zoned as residential. This cap resulted in 130 properties losing their short term rental status. While this week’s property is located outside the residential zone and is therefore not subject to the cap, it is unclear how future regulation would impact the property although perhaps given the nature of the property there may be a way to license it as a boutique hotel.

Conclusion

This is definitely a unique property in an attractive location. The pessimist would view this as a potential money pit, while the optimistic might see a huge opportunity in making the operations more effecient. Regardless, for the right investor this could be an attractive property, but for it to outperform it probably needs to first decide if it is a short term rental property or a boutique hotel and go from there.